Simplify Mergers, Acquisitions, and Divestitures

Corporate restructuring creates challenges for data governance. Cyera helps you protect IP, prove compliance, and ensure visibility and control don't get lost in the shuffle.

De-risk every deal

Cyera helps you perform pre- and post-deal data due diligence, ensure adherence to zero trust access during the transaction, and maintain continuous compliance.

See exactly what data you’re buying or selling

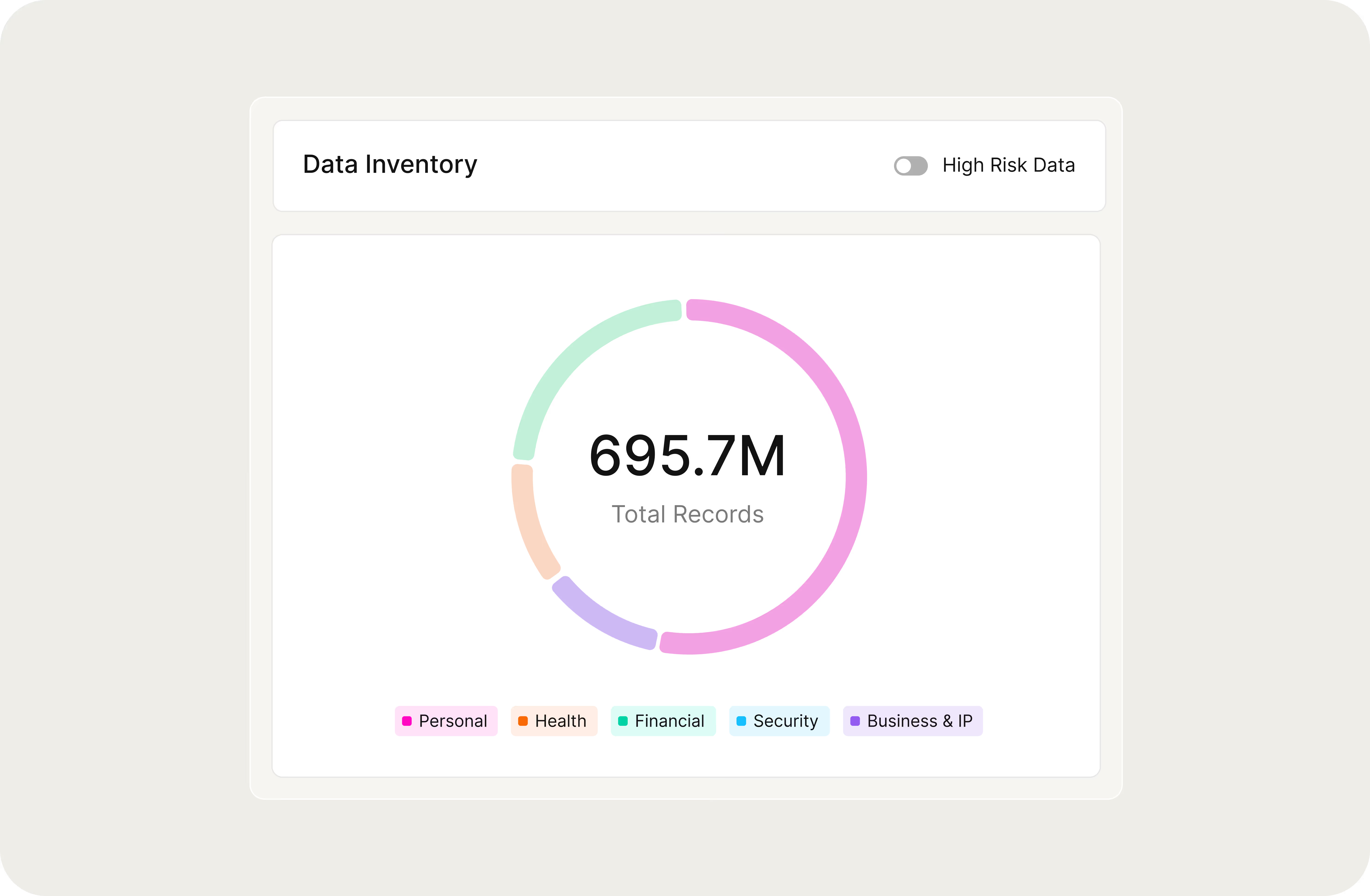

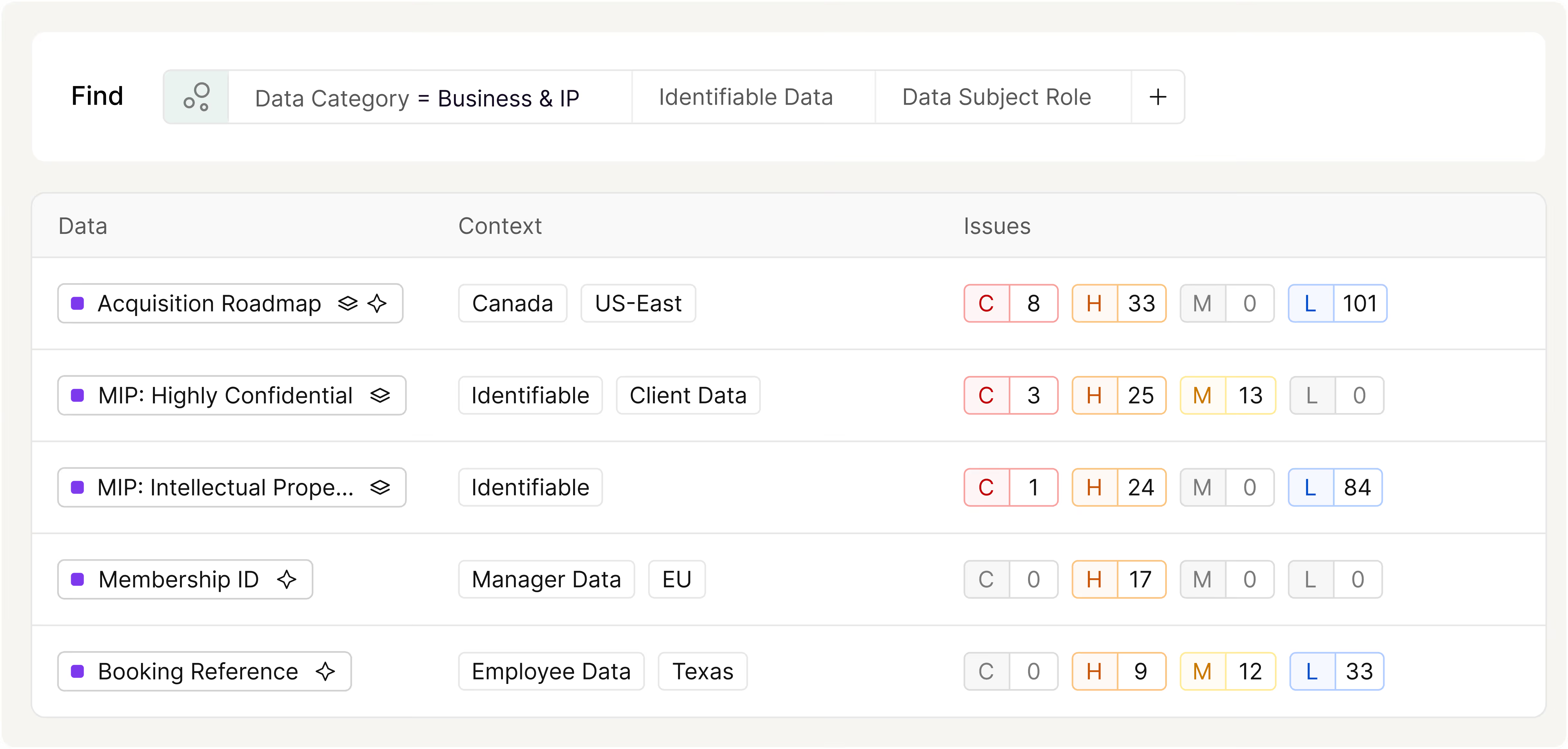

Cyera discovers and classifies data across both entities, highlights where material datasets live, and quantifies unique vs. overlapping data volumes to inform valuation and TSAs.

Control who touches sensitive deal data

Cyera correlates identities with sensitive data, surfaces over‑privileged access, and shows MFA status and anomalous behavior to prevent leaks while teams are working across environments.

Keep regulators, boards, and buyers aligned

Cyera maps data to relevant regulatory frameworks. Out‑of‑the‑box policies and data residency context flag gaps and monitor retention, separation, and deletion as systems are integrated or carved out.

Navigating Real-World M&A Challenges with Cyera

Below are several practical M&A scenarios where Cyera's data and AI security platform deliver value fast.

What data did we just acquire

- Instantly inventory both organizations’ data across cloud and SaaS, surfacing unknown databases, file shares, and SaaS stores tied to the acquired business.

- Automatically classify sensitive data (PII, IP, financials) with clear labels and counts so deal, security, and data teams share a single source of truth.

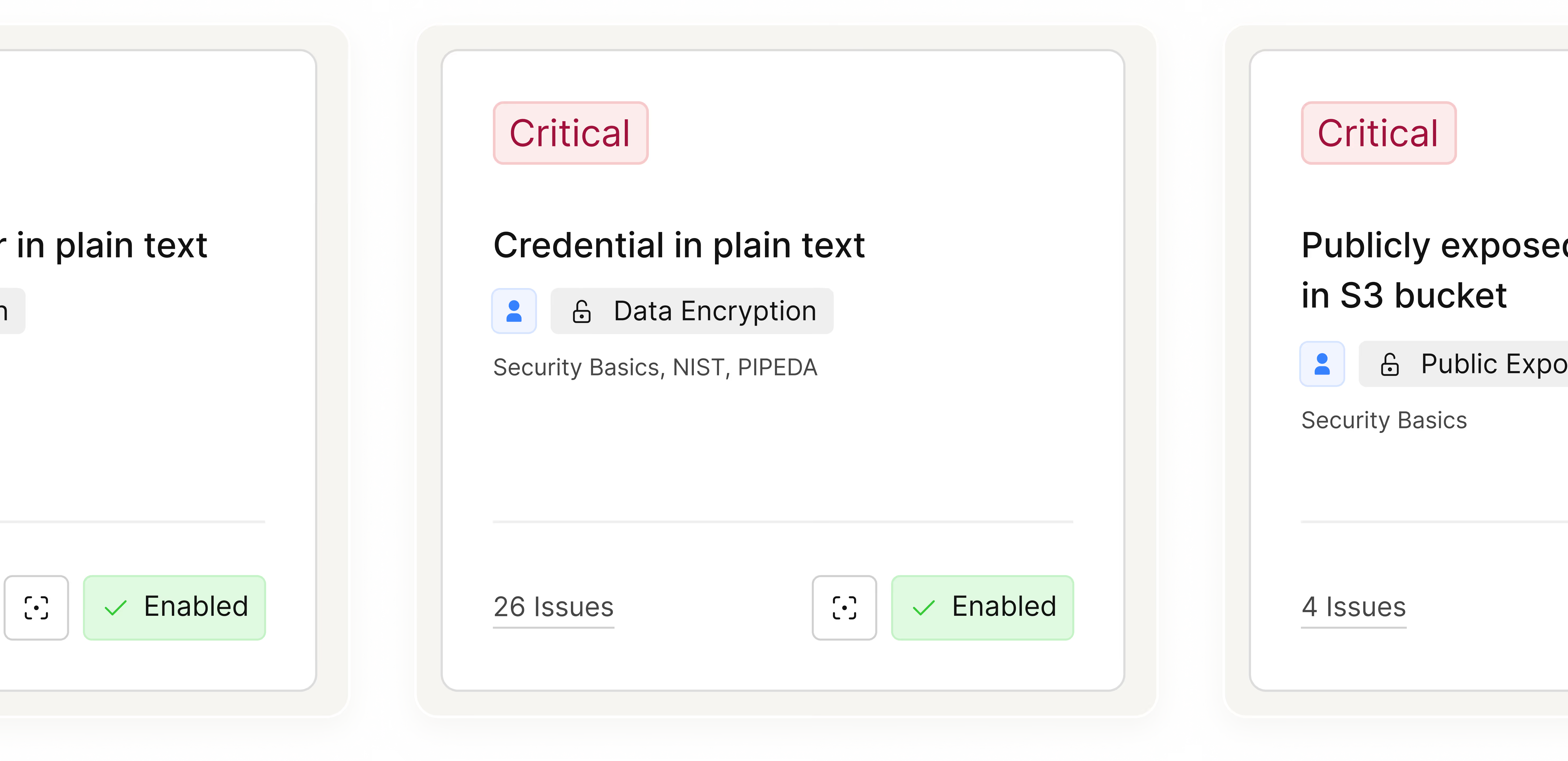

- Highlight highest‑risk stores with exposure and misconfigurations, guiding where to focus integration and risk‑reduction efforts first.

Protecting crown-jewel IP during integration

- Identify and tag critical IP (designs, models, source code, proprietary datasets) across both environments, even when scattered across projects and regions.

- Show which users, groups, and third parties can access those assets, including over‑privileged and stale identities inherited from the target.

- Provides recommended remediation actions (tighten sharing, change roles, encrypt, move) that can be pushed into identity and security systems.

Proving compliance to regulators and the board

- Map discovered data and policies to relevant frameworks (e.g., GDPR, HIPAA, SOC 2) throughout the M&A or divestiture lifecycle.

- Surface violations and gaps (e.g., residency conflicts, missing controls) with clear owners and remediation paths.

- Generate exportable, deal‑specific reports showing what data is in scope, how it’s protected, and what has been remediated to date.

FAQs

Cyera discovers and classifies data across both organizations’ cloud and SaaS environments with high precision, builds a unified inventory of sensitive and material datasets, and surfaces risks like misconfigurations, over‑exposed stores, and regulatory gaps. This gives deal, security, and data teams a single, accurate view of “what data we’re buying or selling” to inform valuation, TSAs, and integration plans.

Yes. Cyera correlates identities with sensitive data, highlights over‑privileged users and third parties, and integrates with DLP, SSE, XDR, and email security to enforce zero‑trust access and prevent data leakage during high‑collaboration phases of the deal.

Cyera maps data and policies to more than 15 frameworks (such as GDPR, HIPAA, CCPA and NIST), applies out‑of‑the‑box and custom policies to detect gaps, and leverages data residency context to monitor data drift across entities and countries. This simplifies audit preparation and helps demonstrate adherence to legal, regulatory, and industry‑specific requirements before, during, and after the transaction.

Traditional tools offer narrow, siloed views. Cyera provides unified, AI‑native discovery, classification, and risk assessment across clouds, databases, SaaS, and AI ecosystems, coupled with integrated DLP (through Omni DLP) to both see and control how data moves. This holistic approach accelerates due diligence, reduces exposure from newly acquired environments, and streamlines post‑deal integration or separation.

.svg)